You’ve found your next home and you’re ready to go for it.

But the bank says the home you want isn’t worth the money you’re willing to pay for it.

Consequently, they’re unwilling to lend it. That’s called down valuing.

It’s a situation no one wants to find themselves in and can lead to property dream heartache and chains collapsing.

So what do you do if it happens to you?

Here we take a look at why properties can be down valued and the options available if your lender says no to loaning you the full amount that you need.

Save money with Mojo Mortgages

Allow award-winning Mojo to show you the best rates available to you. A whole-of-market broker, Mojo work with over 70 lenders. And they won't charge you a penny for their services.

What is down valuing?

Down valuing is where a surveyor, acting on behalf of a lender, assesses a property and says it’s worth less than the price agreed by the seller and buyer.

In other words, the lender won’t provide a loan to cover the seller’s full asking price.

That's because their valuation has revealed the property isn't worth what the seller is asking for - and what the buyer has agreed to pay.

When does down valuing happen?

Down valuing usually happens when you’re selling your home.

You may have found a buyer and agreed with them a sale price of say, £500,000.

It is then down to their lender’s surveyor to find evidence to validate that asking price.

The lender will want reassurance that the property is worth what the buyer wants to borrow for it.

But if the surveyor then values the property at say, £450,000, that’s a hefty down valuation of 10%, which can leave the seller and buyer in a tricky situation.

Why does down valuing happen?

There are a number of reasons why a down valuation might happen.

The seller has set an overambitious price tag on their home

The seller is over-optimistic about the amount of value their renovations have added to their property

Lenders are being cautious about over-inflated prices

The surveyor has found problems with the property

The surveyor has valued a property that's outside of their usual area of expertise. In which case, it's possible they may have been unfamiliar with the nuances of the local markets

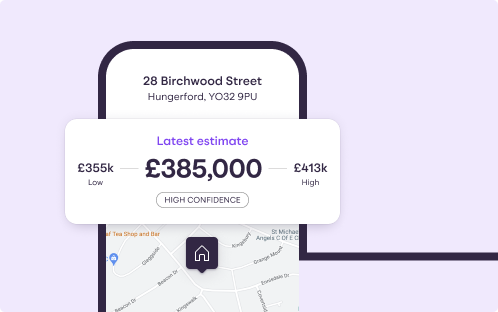

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

How common are down valuations?

Figures suggest that down valuations are quite common.

In fact, research from Bankrate UK, a mortgage comparison site, found that in recent years, almost half of UK properties (46%) were down-valued by lenders.

According to the findings, homes valued between £400,000 and £500,000 have fallen victim to the most devaluations.

What happens if your own home is down valued when remortgaging your property?

While down valuations are most commonly associated with selling and buying a home, they can also prove problematic if you’re looking to remortgage and switch to another mortgage deal without moving home.

Typically, homeowners remortgage because their current arrangement – such as a two-year or five-year fixed-rate mortgage – has come to an end.

If you want to do this, a valuation must be done.

But if the lender determines your home is worth less than you think it is, your application to move to a new lender could get rejected.

In some cases, there may be little option but to move onto your existing lender’s standard variable rate (SVR) which could mean a hefty jump in your monthly mortgage repayments.

How are homes valued?

Properties are valued based on a number of factors:

The overall condition of the house or flat

The size, or ‘square footage’ of the property

The amenities it has (for example, the number of bedrooms, if it has an office or garden, etc)

The sale price of similar local properties in the last six-to-12 months. (This gives an indication of the amount buyers are willing to pay for homes in your area)

Knowledge of supply and demand in the local area

An understanding of the prevailing market – how hot or cold it is, and which way it’s moving

What can you do if down valuing happens to you as a seller?

If you’re looking to sell and your home gets down valued, here are some things you can do:

Find a new buyer with a different lender willing to value your home at the price you think it’s worth

Be willing to lower the asking price

Spend money to address the reasons for the down valuation

Wait to see if the property rises in value. But by doing this, you may risk losing the interested buyer. There’s also the risk that your property could go down in value too, rather than up

What can you do if down valuing happens to you as a buyer?

If you’re hoping to buy, but then get a down valuation from your lender, there are some things you can do to avoid missing out on your dream home.

Get the property valued again by a different surveyor acting for a different lender

Try to renegotiate the price with the seller – or simply lower your offer

Get a loan for the shortfall

Increase your deposit to cover the cost of the devaluation – though this may mean dipping into savings meant for other costs

While down valuations are far from ideal, there is a way out, so don’t lose hope if this happens to you.

With a little effort and perseverance, the sale (or purchase) could still go through.